HOA Accounting and Financial Statements Overview

Understanding Accounting and Financial Statements

865.315.7505

help@csmhoa.com

Understanding Accounting and Financial Statements

HOA accounting is an important aspect of running a homeowners association, but it can be a tedious task. Board members have a responsibility to understand financial interim statements to guide the association’s financial course. This job can be complicated by inaccurate or incomplete financial reports. Poor reporting can make an already immense obligation harder to manage. Therefore, it’s important for all board members to know how to understand and analyze financial reports. This way, they can prepare the association for maintenance, repairs, homeowner bankruptcy, and even financial dishonesty.

To understand the association’s financial position, board members must have an understanding of the accounting method used. There are several methods that may be used to prepare your HOA’s financial statements. In most states, homeowners associations can choose one of three bases of accounting to prepare interim statements:

These accounting methods will be used to prepare several important financial reports for the homeowners association. The most important are the following:

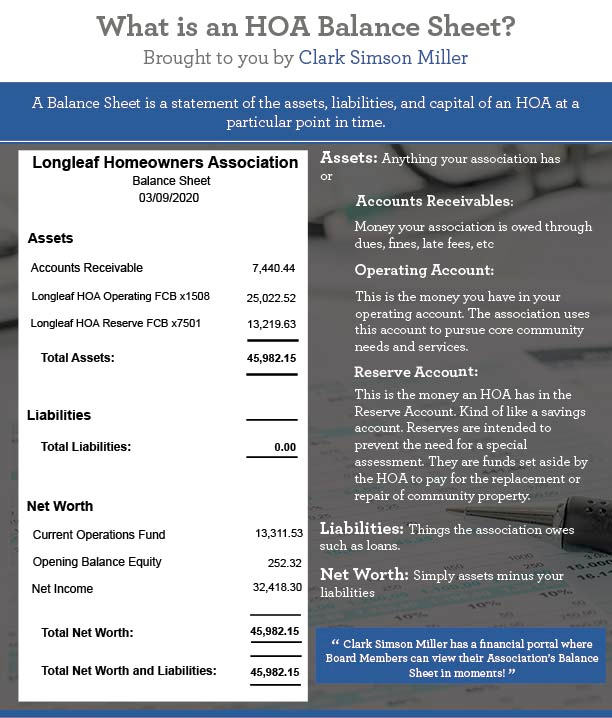

The Balance Sheet explains the association’s financial situation by comparing assets minus liabilities to give a net worth. This report will show how much money is in the HOA’s bank account.

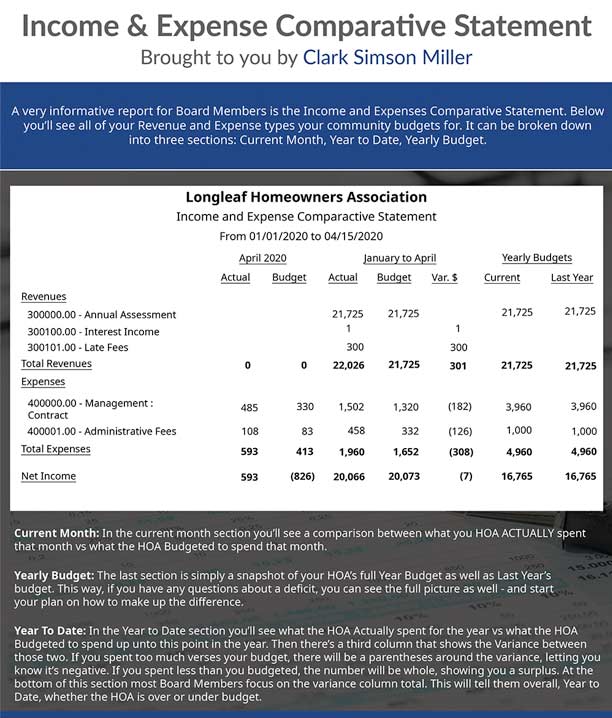

This statement shows transactions for a certain time period — usually one month, quarterly, or annually. This report shows the amount the HOA spent for the time period compared to the budgeted amount for the period.

It’s mandatory to use specific accounting methods in some cases. While it’s not mandatory to seek help from an accounting firm, it may be required to have an independent third-party audit or review the association’s books once a year. Each accounting method comes with unique advantages with a different effect on HOA finances. Thus, it’s important for board members to understand which method the association will use.

Under the accrual basis of accounting, all HOA financial activities are reported on the financial statements. This type of accounting is usually considered superior because it offers the most complete overview of the HOA’s financial status compared to the modified accrual or cash methods. Using the accrual basis, the association reports revenue when it earns them, regardless of when money actually changes hands. In the same way, the association reports expenses when it incurs them.

The accrual accounting method significantly affects how the association records expenses and revenues.

Using this method, the association records expenses when it incurs them, not when it pays them. The Balance Sheet will have an Accounts Payable liability section. As the HOA settles its balances, the association reduces its Accounts Payable and Cash balance.

In terms of revenues, the association records them when it earns them, not when it receives them. An asset section of the Balance Sheet titled Assessments Receivable appears. As the association receives payments, the cash balance increases while Assessments Receivable decreases or Prepaid Assessments increases.

The accrual basis method means the association records transactions daily, weekly, and monthly it incurs them. This results in an automatic generation of very detailed reports. For every report, the total balance must agree with the amounts reported as a liability or asset on the association’s Balance Sheet. The Balance Sheet should have Aged Assessments Receivable as an asset with Accounts Payable and Prepaid Assessments as liabilities until the payment of the amounts.

The three financial reports generated with the accrual basis accounting method are:

The cash basis accounting method records expenses and income when money changes hands.

Using the cash basis, the association reports revenues when it receives them, not when it earns them. As a result, Cash increases on the association’s Balance Sheet. The cash basis accounting method does not include Assessments Receivable or Prepaid Assessments accounts on the Balance Sheet. Recording of expenses happens when the association pays for them, not when it incurs them. Cash balance is the only balance that decreases. There is no Accounts Payable account on the Balance Sheet.

With the cash basis method, amounts for Accounts Payable, Assessments Receivable, and Prepaid Assessments don’t show up on the association’s Balance Sheet. The board may choose to prepare Accounts Payable, Prepaid Assessments, and Assessments Receivable reports. However, the accuracy of the reports cannot be verified easily by comparing the totals to the amounts reported on the Balance Sheet.

The modified accrual basis or modified cash basis combines the cash and accrual basis accounting methods.

Using the modified accrual basis method, the association reports revenues when it earns them, just as with the accrual basis. Expenses, on the other hand, follow the cash basis method. This means the association reports them as it pays for them, not when it incurs them.

With the modified accrual basis method, the amounts for Prepaid Assessments and Assessments Receivable will be the same as the amounts on the Balance Sheet, just as with the accrual basis method. If unpaid invoices appear under Accounts Payable, the amounts will differ from those recorded on the Balance Sheet. This is because the recording of expenses follows the cash basis and not the accrual basis.

The California Civil Code has many requirements for homeowners association interim financial statements.

Civil Code Section 5300(b)(1) requires that the annual operating budget distributed to the membership every year follow the accrual basis. The law requires associations to prepare pro forma operating budgets that include all estimated expenses and revenues using the accrued basis method of accounting.

Because the annual operating budget must be prepared using the accrual basis, the Income Statement should follow on the same basis. The Income Statement compares actual expenses and revenues reported for the period with estimated expenses and revenues reflected in the budget.

According to Civil Code Section 5500(c), the Board of Directors must review the current year’s actual expenses and revenues compared to the year’s budget at least quarterly. The HOA board must review HOA finances for reserve and operating expenses. Because the budget must follow the accrual basis, financial statements should also follow the accrual basis.

Civil Code Section 5200(a)(3)(d) states that records must follow an accrual or modified accrual basis whenever an HOA member requests copies of the association’s financial records.

The accrual basis of accounting is generally recommended for homeowners associations as it meets the requirements of the California Civil Code. With the accrual basis, all revenue and expenses appear in the HOA’s Income Statement and amounts are comparable to the budget. The Balance Sheet will also include Accounts Payable, Prepaid Assessments, Assessments Receivable, and totals for each that agree with detailed reports for easier management of the association’s finances.

The cash method is popular because it is very straightforward: like a checking account, this method tracks when money comes in and when it goes out. While the cash method of accounting is easy to prepare and understand, it ignores unpaid bills and uncollected HOA fees.

While some associations use a cash basis, this comes with drawbacks. Under the cash basis, financial reports can be misleading because amounts are not always comparable to the budget and the income statement may not reflect all incurred expenses or revenue earned. Using the cash basis method, the Balance Sheet will not  include Accounts Payable, Prepaid Assessments, or Assessments Receivable, and the association’s financial information may be incomplete. It’s true that board members and managers are usually more interested in how much cash came in and out during any given period, but cash flow is available in other financial information like bank records at the end of each month.

include Accounts Payable, Prepaid Assessments, or Assessments Receivable, and the association’s financial information may be incomplete. It’s true that board members and managers are usually more interested in how much cash came in and out during any given period, but cash flow is available in other financial information like bank records at the end of each month.

When an association uses the cash accounting method, it is especially important to consider the long-term. There must be some way to review upcoming expenses to avoid making financial decisions based on what financial reports and balances indicate is available. It’s also important to have a realistic budget to avoid making decisions based on the income that may not be collected.

Many California HOAs use the modified accrual basis as it offers some benefits of the accrual method with advantages of the cash method. Some HOA boards feel it is easier to record expenses as they are paid instead of when they occurred while recognizing that revenues should be recorded when they are earned as with the accrual basis method. The accrual basis method offers this advantage without compromising as long as the books remain open for two weeks after the end of the accounting period to record expenses in the correct period.

While the modified accrual method is less complex than the accrual method, the main downside is it does not always accurately match all expenses and income in the fiscal month in question. This can distort the association’s real financial situation. Because expenses follow a cash basis, monthly reports may mislead associations. As an example, if the board approves a $50,000 roofing contract, it will not show up on monthly reports until the check is written. The board may think it has extra money because the $50,000 is an obligation not yet on the books.

Glossary of HOA Accounting Terms

HOA State Laws

The Main Functions of Accounting

Accrual Accounting vs Cash Accounting

Hiring a Financial Manager for Your Community

Reserve Funding 101

HOA Statement of Receivables

The Complete Guide to HOA Financial Statements

Community Association Institute

HOA Management Blog

IREM

APRA

Condo and HOA News