Understanding the Main Functions of Financial Accounting

The main functions of accounting are to keep an accurate record of financial transactions, to create a journal of expenditure, and to prepare this information for statements that are often required by law. The most basic of accounting functions is to record the data.

Several years ago, this would have been logged into ledger books, journals, and balance sheet books. At the time, an organization would need to use a number of manually recorded systems. Today, however, these recordings are all entered into a dedicated software system.

All financial transactions go into the general journal. Not only do you need to record these transactions, but you must also write them down in a systematic manner to ensure consistency. You must enter these transactions using a double-entry bookkeeping system using basic accounting principles. This system specifies whether the financial transaction debits (takes money from) or credits (adds money to) a particular account. When you change a transaction on the journal, it should automatically update or amend the entry on the ledger balance.

The analysis of the recorded data is noted in the ledger book, which is simply a summary of the journal. Entries of a certain nature are all grouped here. So, if you want to look at how much money has been spent or received on maintenance, for example, you are likely to find the information here.

You then summarize the ledger book so that even external parties can view the transactions made and easily understand what the summary is showing them. The next function of accounting, which leads on from this, is the preparation of three important financial statements:

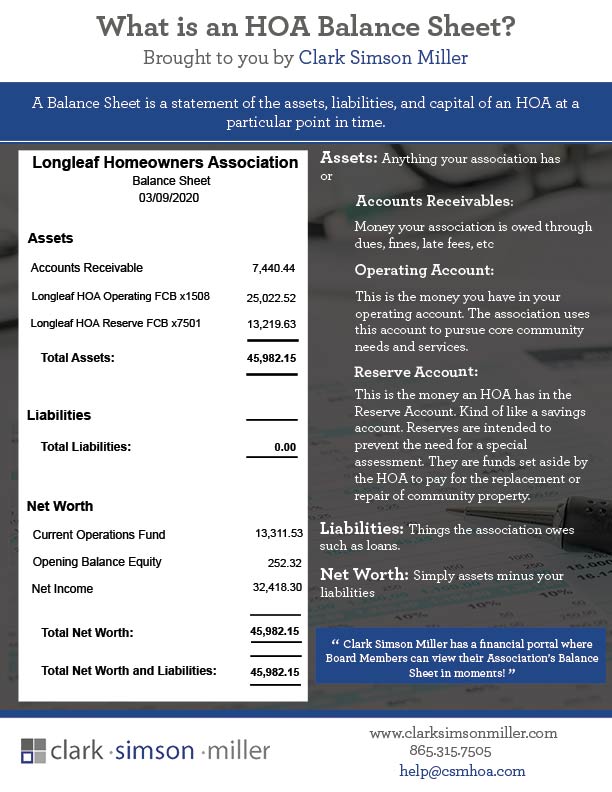

1. Balance Sheet

The balance sheet summarizes the financial balances of a community association or management company at a given point in time. This includes assets, liabilities, and ownership equity.

2. Income Statement

The income statement (also known as a profit and loss statement) shows the revenues and expenses across a certain quarter, month, year or period selected. This statement shows managers and homeowners whether the association made or lost money during this time period.

3. Cash Flow Statement

The cash flow statement breaks down an association’s income and expenses into an itemized list. In a homeowners or condo association, the income will almost exclusively come from homeowner assessments (dues). However, the cash flow statement shows exactly where the association’s money goes, item-by-item.

The final function of accounting is to analyze and interpret these figures so that external parties can see the profitability of a community association.

How Clark Simson Miller Can Help

Clark Simson Miller provides remote accounting services for the country’s community associations and the companies managing them. We handle all of these basic financial functions and more from our offices in Florida and Wyoming. Our virtual accounting procedure ensures all books are clearly analyzed, interpreted, and communicated. Our experienced and dedicated staff and our proprietary technology allow our firm to lead communities and management companies to financial independence.

Industry Resources

Glossary of HOA Accounting Terms

HOA State Laws

The Main Functions of Accounting

Accrual Accounting vs Cash Accounting

Hiring a Financial Manager for Your Community

Reserve Funding 101

HOA Statement of Receivables

The Complete Guide to HOA Financial Statements

What is Remote HOA Management?

Association Links

Community Association Institute

HOA Management Blog

IREM

APRA

Condo and HOA News