Knowing what the HOA standard financial statements are as well as how these documents represent the movement of money within a homeowners association, are vital for transparency and accuracy. Homeowners pay monthly/annual dues. The last thing they’d want is to be kept in the dark as to where the funds are being allocated.

Standard Financial Statements Your HOA Must Have

Volunteers working for the homeowners association may find financial reporting a tedious task. But, the HOA board and its members should still know how to understand and analyze these documents for accurate financial reporting. To get started, here’s a quick guide on the standard financial statements your HOA must maintain:

1. Balance Sheet

The Balance Sheet is a financial statement that shows the financial situation of the association, basically showing its net worth. This report takes into account the assets, liabilities, and equities to show the overall financial health of your HOA.

If you want a quick rundown of your HOA’s financial condition, the Balance Sheet is your answer.

The Balance Sheet follows a simple formula:

Assets = Liabilities + Equity

As the name suggests, the two sides of the equation should be balanced. Otherwise, the bookkeeper must go back and check the books to see what’s causing the imbalance.

Assets

Assets are divided into current and noncurrent. Current assets are items the association can easily convert into cash within the year. Noncurrent assets work the same way, except they take longer to convert into cash (more than a year). These assets include fixed assets, which are things the association uses but cannot sell immediately, like office furniture.

Liabilities

While assets are where the money comes from, liabilities are where the funds are spent on. Simply put, liabilities are expenses the association must pay off. Liabilities are broken down into current and long-term. The current liabilities are expenses the association needs to pay off within a year. Meanwhile, the long-term liabilities are obligations that can be settled even after a year.

Equity

Also known as shareholders’ or owner’s equity, this is the amount of money returned to shareholders once the assets are liquidated and when the liabilities are paid off. The formula for this is:

Equity = Assets – Liabilities

In making the Balance Sheet, items must be correctly classified under assets or liabilities. A simple mistake can cause an imbalance and can even make your finances appear less healthy than it really is. Every Balance Sheet is closed after a year. If your equity is positive (which means your assets are bigger than your liabilities), that’s good!

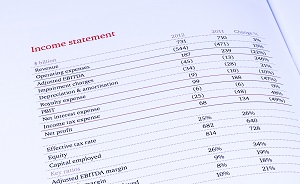

2. Income Statement

The Income Statement is otherwise known as the Profit-Loss Statement or the Statement of Income & Expense. It is the financial report that tallies the association’s profits and losses within an accounting period. Both cash and non-cash gains and losses are recorded here.

The Income Statement is otherwise known as the Profit-Loss Statement or the Statement of Income & Expense. It is the financial report that tallies the association’s profits and losses within an accounting period. Both cash and non-cash gains and losses are recorded here.

Income Statements are divided into two components: operating and non-operating. The document shows revenues or total sales. Bookkeepers count and record every sale made, like the tickets sold to the homeowners for the night gala or gate fees for deliveries.

The expenses reflect all operating expenses, such as cost of goods, cost of services, rent expenses, bank fees, utilities, salaries for employees, etc. Losses will also include accruals.

Like all HOA financial statements, this one must be prepared accurately. This financial statement shows profitability, and any inaccuracy can result in unnecessary costs and wrong inventory projections. It may also affect the profitability ratios of the association. After all, some communities need to earn extra money for the benefit of the community, too, like a Father’s Day buffet or Halloween costume party.

3. Cash Flow Statement

A Cash Flow Statement shows how cash flows in and out of your HOA. It shows where the money is coming from and where it is going.

A Cash Flow Statement shows how cash flows in and out of your HOA. It shows where the money is coming from and where it is going.

While it seems like its purpose is similar to an Income Statement, a Cash Flow Statement only works with cash transactions. The cash inflows and outflows come from three financial activities: operations, investments, and financing.

The Cash Flow Statement is a snapshot of the association’s liquidity and solvency. Within the community, the cash flow statement is a gauge of the association’s ability to fulfill upcoming obligations, like the salary of employees. The cash flow recorded should be the same as the increase or decrease of cash transactions in the Income Statement for accurate reporting.

4. General Ledger

While not technically a financial statement, a General Ledger remains one of the most important accounting records for a business. This book holds all of the association’s financial records, sorted by account number and date. It allows your HOA to track all financial transactions without having to look back on all your receipts.

A General Ledger works as a master record. Other standard financial statements use it as a basis of comparison. Of course, your financial books are only as accurate as the records you keep. So, make sure to diligently jot down every transaction without fail.

5. Accounts Payable Report

An Accounts Payable Report shows you all the HOA’s outstanding debts at one glance. It is a master report of everything you owe, with all the necessary details included. This report shows you how much you owe and to whom you owe the money to.

An Accounts Payable Report shows you all the HOA’s outstanding debts at one glance. It is a master report of everything you owe, with all the necessary details included. This report shows you how much you owe and to whom you owe the money to.

No matter how great your memory is, remembering all your debts is a nearly impossible task. Homeowners associations work with all kinds of vendors and service companies. It is important to maintain a healthy working relationship with them. But, you can’t do that if you are always behind on your payments.

6. Account Delinquency Report

Your association collects regular assessments from homeowners, but not all of them are good payors. Some of them will forget to settle their fees or outright refuse to do so. For such cases, you must have an Account Delinquency Report. This report helps you keep track of all late or delinquent homeowners. In short, it shows you the HOA’s total accounts receivables.

An Account Delinquency Report typically consists of two parts: the resident name and the amount they owe. The latter is further classified into Current, Over 30 Days, Over 60 Days, and Over 90 Days. This way, you can tell by how much and how long a homeowner has been behind with just one look. It also makes collection easier.

7. Cash Disbursements Ledger

A Cash Disbursements Ledger is a specific report that shows you how much money your HOA is spending. This is important to help give your HOA an overall look at its expenditures. While a Cash Flow Statement only records cash transactions, this statement takes both cash and checks into account. This is why it is also sometimes referred to as a Check Register. Details you must include in a Cash Disbursements Ledger include:

- Date

- Payee

- Amount

- Description of expense

- Check date (if applicable)

- Check number (if applicable)

- Invoice number

HOA and Financial Management Services

You must have a sound understanding of these standard financial statements for HOAs. By doing so, you can assess the association’s current financial standing. This will help them make projections and plan for the next financial year. There’s no excuse for unbalanced and inaccurate books at the end of every accounting year. Not only will this look bad to the homeowners, but this can lead to homeowners taking legal action.

On the other hand, not all HOAs are expected to be able to come up with financial reports on their own. This is why homeowners associations look for a financial management service provider. In that case, don’t hesitate to contact us for help.

RELATED ARTICLES:

- What Is An HOA Statement of Receivables?

- What Is An HOA Income Statement?

- Understanding An HOA General Ledger