Tax season is upon us, and if you are new to filing taxes with your HOA, you may have many questions about which forms need to be filed, whether you are tax exempt, and what to do if your HOA has not filed in a couple of years. In this post, we will answer some of the most commonly asked questions regarding HOA taxes.

Everything You Need to Know About HOA Taxes

Filing HOA taxes is a difficult undertaking for inexperienced board members. You don’t know which HOA tax reports to file and whether some of your income is exempt from taxes. But, you can’t just skip tax season and hope it gets easier next year. HOA taxes are crucial, and you run the risk of suffering large fines when you fail to file them. If you are a beginner in the world of homeowners association taxes, here are the frequently asked questions about HOA tax reporting requirements:

1. Does an HOA Have to File Tax Returns?

Homeowners associations can be tricky because they can be viewed as nonprofit organizations by the state. However, almost every HOA is considered by the federal government as corporations. So, do homeowners associations have to file tax returns? Short answer, yes. Because HOAs are regarded as corporations, most HOAs have to pay taxes to the IRS even if they are listed as a nonprofit through the state.

Homeowners associations can be tricky because they can be viewed as nonprofit organizations by the state. However, almost every HOA is considered by the federal government as corporations. So, do homeowners associations have to file tax returns? Short answer, yes. Because HOAs are regarded as corporations, most HOAs have to pay taxes to the IRS even if they are listed as a nonprofit through the state.

As with most things, though, there are exceptions. Some HOAs may be recognized by the IRS as a nonprofit if it has registered as such and been approved. This is a rare case, however, and is obtained only by filing Form 1024 and using tax code section 501(c)(4).

2. What HOA Tax Forms Should an HOA File?

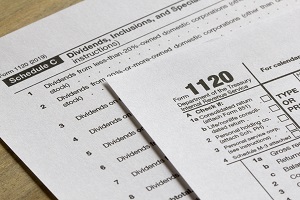

Most HOAs have to file Form 1120 in their tax returns. This form can be an arduous form to fill out, consisting of several pages and a large amount of information required.

Most HOAs have to file Form 1120 in their tax returns. This form can be an arduous form to fill out, consisting of several pages and a large amount of information required.

There are other drawbacks to this form as well, as any money left unspent at the end of the year is subject to being taxed. Plus, the treasurer of the board has an added workload with this form as money must be set aside by them throughout the year.

Any HOA filing Form 1120 should be meticulous about record-keeping throughout the year to make gathering the information needed and paying these taxes as easy as possible.

3. Is There a Way to Get Out of Filing Form 1120?

Because of the time-consuming nature of Form 1120, many HOAs are eager to bypass this form. Certain homeowners associations may have this option if more than 60% of the annual income of the association comes from sources such as membership dues, fees, interest, or special assessments. Also, 90% or more of these funds must be used towards the maintenance or addition of the property itself. If these two requirements are met, the HOA can utilize section 528 of the tax code and file Form 1120-H instead.

Because of the time-consuming nature of Form 1120, many HOAs are eager to bypass this form. Certain homeowners associations may have this option if more than 60% of the annual income of the association comes from sources such as membership dues, fees, interest, or special assessments. Also, 90% or more of these funds must be used towards the maintenance or addition of the property itself. If these two requirements are met, the HOA can utilize section 528 of the tax code and file Form 1120-H instead.

4. Are There Any Benefits If You Qualify for Form 1120-H?

An HOA files this form as its income tax return to take advantage of certain tax benefits. By filling this form, an HOA is able to exclude exempt function income from its gross income. In short, your HOA only needs to pay taxes on non-exempt income.

So, what are some examples of non-exempt income? This can be income you gained from renting a property the HOA owns. It also includes any income you earned from vending machines. Additionally, dividends and interests fall under this umbrella as well. Of course, you will need supporting documents to tag these revenues as non-exempt.

5. Does My HOA Need to File Form 1120-H Every Year?

An HOA must qualify each year by filing an 1120-H before the 15th day of the 3rd month after the end of the HOA’s tax year. Qualification is not permanent. As such, if you fail to file Form 1120-H before the due date, you cannot qualify for the form for that year anymore.

6. Are There Any Tax Exemptions for an HOA?

HOAs may qualify for tax exemption as a social welfare organization as long as they maintain common areas, streets, and sidewalks. The association would also have to provide evidence along with an exemption application that shows evidence that areas such as parks and roadways are open to the general public. Additionally, an HOA may elect to be categorized as a nonprofit tax-exempt organization by the IRS. However, the IRS does not grant this status lightly.

7. When Should My HOA File Taxes?

A homeowners association is considered a nonprofit organization. Therefore, you must look to your fiscal year to determine the deadline for filing HOA taxes. For instance, if your fiscal end date is December 31, then you must accomplish your tax returns before March 15. So, make sure to have your homeowners association tax filing requirements settled before then.

A homeowners association is considered a nonprofit organization. Therefore, you must look to your fiscal year to determine the deadline for filing HOA taxes. For instance, if your fiscal end date is December 31, then you must accomplish your tax returns before March 15. So, make sure to have your homeowners association tax filing requirements settled before then.

8. What If My HOA Failed to File Tax Returns?

If it has been several years since your HOA has filed the appropriate tax returns, there are several steps that you should immediately take. First, find the most recent tax return to determine how long it has been since your HOA filed. Second, fill out the most recent HOA tax return in a timely fashion. Third, contact the IRS to determine whether it is possible to file a Form 1120-H for the missed years. Fourth, file all of the tax returns that were missed in previous years.

The Answer to HOA Taxes Filing

Tax season can be a stressful time. But, knowledge and experience can greatly help you go through it. If you have been faithful about keeping records and filing your forms on time, your association will come through the season intact.

Most HOA boards consist of volunteers from the community. These volunteers usually have to juggle other priorities. With so many tasks occupying their time, HOA taxes can slip through their minds easily. If you find that your HOA is experiencing the same issue, it may be time to consider outsourcing HOA taxes filing. Seek the help of a lawyer or partner with a remote HOA management company like us to lift some of the weight off your shoulders.

RELATED ARTICLES:

- Why Do You Need A CPA For An HOA And How To Find One?

- FHA Condo Approval: Frequently Asked Questions

- California’s Accessory Dwelling Unit Law: What Is This About?